Discover top Wheon.Com finance tips to steady your monetary destiny with effective money management techniques.

Introduction to Wheon.Com finance tips

Welcome to Wheon.Com, your pass-to hub for sensible and powerful finance tips! Whether you are striving to reinforce your budgeting competencies or keen on understanding money management higher, we’re right here to guide you. Our aim? To assist you steady a bright economic destiny. In this weblog, we’re going to unravel the secrets to savvy spending and clever saving, making sure that your financial roadmap isn’t always only a plan however a fulfillment story inside the making. Ready to dive in? Let’s embark on this economic adventure together!

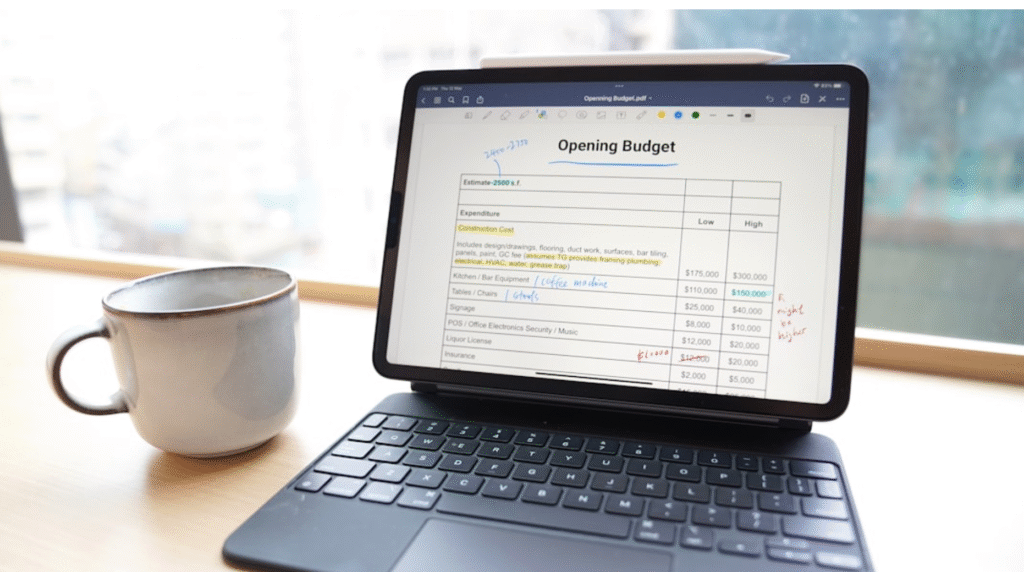

Budgeting Basics

Embarking on the adventure to economic balance starts offevolved with getting your budgeting sport on factor. Whether you’re just starting out or need a little reminder, getting to know the art of budgeting can make a international of difference. Here’s how you may address it like a seasoned.

Understanding Income and Expenses

First matters first, let’s play detective along with your dollars. Begin by way of figuring out all assets of profits. This may encompass your profits, any side hustles, or maybe passive income streams like dividends. Knowing precisely how plenty money is coming your manner each month sets a strong basis.

Now, allow’s healthy those dollars in opposition to your costs. Categorize them into necessities like housing, groceries, and transport, after which non-necessities like eating out or entertainment. This comprehensive view facilitates you parent out in which each penny is going.

Creating a Realistic Budget

Armed with the know-how of your profits and fees, it’s time to craft a price range that displays your actual existence, now not a few idealized model of it. The key phrase right here is “realistic.” Allocate quantities of your earnings to distinct fee categories, ensuring priorities like payments and savings come first.

Don’t forget about to depart some wiggle room for amusing money or unexpected prices. A price range that’s too rigid is a fixed-up for failure, even as one it is too lax might not assist you live on the right track. Balance is your pleasant pal here.

Tracking and Adjusting Your Budget Regularly

Budgeting isn’t a one-and-achieved deal. Your financial situation and priorities will shift through the years, so make sure to revisit your finances often—monthly or even weekly. Use apps to track your spending or surely jot things down in a notebook.

Adjust your budget to deal with changes. Did you get a increase? Fantastic! Why no longer funnel a touch more into savings? Are prices strolling higher than predicted? Time to trim a few fats. The more you actively have interaction with your finances, the higher off your pockets will be.

Managing Debt Wisely

Once you’ve got tackled budgeting, it is time to deal with the no longer-so-fun component: debt. While debt can feel like a heavy cloud soaring above, fear no longer! By know-how and handling your debt effectively, you’ll quickly see a few sunshine.

Types of Debt and Prioritizing Repayments

All debt is not created equal. You’ve got your “exact” money owed, like student loans or mortgages, which could in reality construct your credit score or boom your internet worth. On the alternative hand, there is “awful” debt, like high-interest credit cards, that can drag you down.

Prioritizing debt compensation means focusing at the latter. Start by using list out all your money owed along side their interest fees. Your priority? Tackle those high-hobby chains first, as they’re more expensive ultimately.

Strategies for Reducing Debt

When you’re ready to hack away at the ones debts, don’t forget the following:

- Snowball Method: Attack your smallest debt first. Once it’s long gone, observe that fee to the next smallest. This gives you quick wins and builds momentum.

- Avalanche Method: Pay off the very best hobby debt first. It saves more money, although the exhilaration of paying off smaller debts would possibly take longer.

- Consolidation: Sometimes, combining more than one debts into one lower-hobby loan can simplify matters.

- Negotiate: Don’t be shy to name your lenders. They would possibly provide decrease hobby costs or price plans.

Whatever method you pick, perseverance and a strong plan are your allies.

Avoiding Common Debt Traps

Finding your self in debt is disturbing, however entering into debt traps could make things even worse. Here’s what to persuade clear of:

- Minimum Payments: Only paying the minimum drags your repayment technique all the time and racks up hobby.

- Impulse Spending: That purchasing spree might be a laugh now, but consider its lengthy-time period impact to your credit card invoice.

- Lack of Emergency Fund: Without a monetary safety net, sudden costs can send you deeper into debt.

Building a stable financial foundation entails sidestepping those pitfalls. Resist the temptation and live disciplined.

By nailing those budgeting fundamentals and handling debt strategically, you’re laying the groundwork for a secure monetary future. With resources like Wheon.Com at your fingertips, you may soon be taking part in the freedom that includes savvy cash management. Let the adventure to monetary empowerment start!

Building an Emergency Fund

An emergency fund is the economic safety net that everybody desires. It’s your cross-to stash when life throws you surprising curveballs, like a unexpected job loss, medical emergency, or even a vehicle breakdown. Let’s wreck down why you want one, a way to get started out, and the fine methods to keep it from draining away.

Importance of an Emergency Fund

Think of an emergency fund like a superhero cape—it is there to protect you in times of crisis. Without it, sudden expenses can throw your whole monetary plan astray. Here’s why it’s vital:

- Peace of Mind: Knowing you have backup budget can reduce pressure and assist you focus on resolving the crisis instead of panicking about cash.

- Avoid Debt: By the usage of coins out of your emergency financial savings in place of credit, you avert high-hobby debt that can spiral out of manipulate.

- Financial Stability: It acts as a buffer, so existence’s surprises don’t derail your financial goals.

How to Start and Maintain Your Fund

Starting an emergency fund doesn’t ought to be daunting. Here are a few pleasant recommendations:

- Set a Goal: Begin with a small, sensible goal, like $1,000, and step by step build it up.

- Open a Separate Account: Keep your emergency funds in a separate high-yield financial savings account so they’re on hand but not tempting to spend.

- Automate Savings: Set up automated transfers from your checking account for your savings account every payday.

- Trim Expenses: Identify non-essential fees to your price range that you may lessen or take away to boost your fund.

Consistency is prime. Regular contributions, irrespective of how small, will progressively develop your fund.

Determining the Right Amount for Your Needs

How a good deal money ought to you purpose to store? The amount varies depending on man or woman situations, but there are wellknown tips:

- Rule of Thumb: Aim for three to six months’ really worth of residing charges. This usually covers lease or mortgage, groceries, bills, and other necessities.

- Single vs. Dual Income Households: Single-profits households may also want to save towards six months, while dual-profits houses would possibly manage with simply three.

- Personal Risk Factors: Consider your type of employment, process safety, own family size, and health as factors that dictate how much to save.

Tailor your savings intention to suit your lifestyle and make sure it covers what you would possibly want in an emergency.

Smart Investment Strategies

Investing wisely is the next step in the direction of securing your monetary future. It can appear complicated, but once you get acquainted with some concepts, you’ll locate choosing smart strategies may be both empowering and profitable.

Introduction to Investment Options

The international of funding gives a multitude of choices. Here’s a short rundown of normally to be had alternatives:

- Stocks: These constitute ownership in a employer. Stocks can be excessive-threat however often yield high returns.

- Bonds: Loans you are making to a organisation or government entity with returns at a hard and fast hobby charge—typically decrease threat.

- Mutual Funds: These funds pool money from many buyers to buy a assorted portfolio of stocks or bonds.

- Real Estate: Investing in assets both for apartment income or appreciation over time.

Each funding kind carries its own dangers and rewards, so it’s critical to do your research or consult with a financial consultant earlier than diving in.

Diversifying Your Investment Portfolio

Remember the phrase, “Don’t placed all of your eggs in one basket”? That’s diversification in a nutshell. It involves spreading your investments throughout distinct asset instructions to manipulate hazard greater efficiently. Here’s a way to diversify accurately:

- Mix Asset Classes: A balanced portfolio of shares, bonds, and other funding automobiles facilitates spread hazard.

- Geographic Diversification: Consider worldwide investments to mitigate risks related to neighborhood marketplace downturns.

- Industry Variety: Invest in various sectors (like generation, healthcare, and finance) to keep away from overexposure to 1 enterprise.

Diversification can stabilize returns and decrease the effect of marketplace volatility.

Long-term Investment Planning

Think of making an investment as a marathon, not a sprint. Long-term strategies recognition on sustainable growth the usage of time on your gain. Here’s how you could plan correctly:

- Start Early: The sooner you begin investing, the extra time your investments ought to develop through compound hobby.

- Set Clear Goals: Determine what you’re saving for—retirement, training, a down fee on a residence—and plan funding techniques accordingly.

- Review and Adjust: Regularly compare your portfolio. Rebalance if essential to keep your desired level of chance and to align with converting life dreams.

Staying targeted at the long-term can help you journey out short-term market swings and stay on direction for monetary success.

By incorporating these finance recommendations from Wheon.Com, you may be taking proactive steps to steady your monetary future with solid money control and budgeting strategies. Happy saving and investing!

Conclusion

Securing your monetary future doesn’t have to be overwhelming. By implementing those finance tips from Wheon.Com, you could take price of your cash with self assurance. Remember, a success money management isn’t approximately the dimensions of your earnings but the way you cope with it. Start these days with small steps like growing a budget, monitoring your spending, and placing workable goals. And usually prioritize your wishes over wants. With the proper strategies, you’re on your manner to a secure financial future. Happy budgeting!

Pingback: Navigating the Latest Wheon.com Health News: What You Need to Know best guide 2025 - thewheon.co.uk

Pingback: Get Latest Financial Insights Aggr8Finance What's Trending This Quarter best guide 2025 - thewheon.co.uk

Pingback: Valgensin Unveiled The Mysterious Force Blending Fantasy, Motivation & Tech Innovation - thewheon.co.uk

Pingback: Rebecca Sneed Net Worth Revealed: How She Built a $4 Million Fortune - thewheon.co.uk